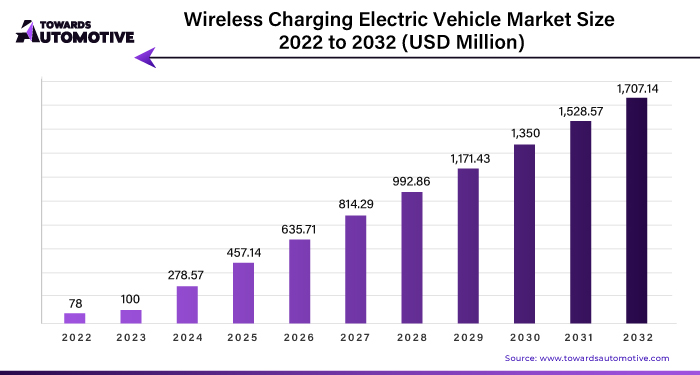

Wireless Charging Electric Vehicle Market Size to Worth USD 1,707.14 Mn by 2032

The global wireless charging electric vehicle market size is calculated at USD 278.57 million in 2024 and is expected to be worth around USD 1,707.14 million by 2032, growing at a double-digit CAGR of 37.06% from 2024 to 2032.

/EIN News/ -- Hong Kong, May 06, 2024 (GLOBE NEWSWIRE) -- The global wireless charging electric vehicle market size surpassed USD 100 million in 2023 and is anticipated to reach around USD 1,528.57 million by 2031, a study published by Towards Automotive a sister firm of Precedence Research.

Focus On Wireless V2G Energy Transfer

Vehicle-to-grid (V2G) technology represents a significant advancement in the integration of electric vehicles (EVs) into the broader energy ecosystem. Essentially, V2G enables bi-directional communication between EVs and the electrical grid, allowing EVs to not only draw power from the grid but also to feed excess energy back into it. This capability holds considerable promise for optimizing energy usage, grid stability, and overall efficiency.

As the adoption of electric vehicles continues to rise globally, particularly in regions like the Asia-Pacific, where governments are actively promoting EV adoption to address environmental concerns such as air pollution and greenhouse gas emissions, the potential for V2G technology to make a meaningful impact grows exponentially. For instance, China, a key player in the global automotive market, has set ambitious targets for electric vehicle deployment to mitigate emissions and combat climate change.

Download a short version of this report @ https://www.towardsautomotive.com/insight-sample/1031

The economic, environmental, and operational benefits of V2G are compelling factors driving its increasing demand. From an economic standpoint, V2G presents opportunities for EV owners to monetize their vehicle batteries by participating in grid services, such as peak demand shaving, frequency regulation, and energy arbitrage. This can result in cost savings for consumers and additional revenue streams for EV owners, thereby enhancing the economic viability of electric vehicles.

Moreover, V2G offers environmental advantages by facilitating the integration of renewable energy sources, such as solar and wind power, into the grid. By leveraging EV batteries as distributed energy storage resources, V2G can help smooth out fluctuations in renewable energy generation and enhance grid stability. This contributes to the overall decarbonization of the energy sector and supports the transition to a more sustainable energy future.

V2G has the potential to improve grid resilience and reliability by providing grid operators with additional flexibility and capacity to manage supply-demand dynamics in real time. By leveraging the aggregate capacity of EV batteries connected to the grid, V2G can help mitigate grid congestion, reduce reliance on fossil fuel-based peaker plants, and enhance overall grid efficiency.

The increasing adoption of electric vehicles coupled with the multifaceted benefits of V2G technology position it as a key enabler of a smarter, more sustainable energy ecosystem. As governments, utilities, automakers, and other stakeholders continue to recognize the value proposition of V2G, its deployment is expected to accelerate, driving innovation and reshaping the future of energy management and transportation.

As the country transitions to renewable energy sources like wind and solar, electric vehicles and their batteries may assist transmit energy to the grid, balancing supply and demand. For example, WiTricity claims that wireless charging can enhance the whole V2G (vehicle-to-grid) experience. Wireless electric car charging has been shown to facilitate vehicle-to-grid (V2G). This will contribute to the creation of a robust and reliable electrical grid. All of the aforementioned should contribute to the income of the electric vehicle wireless charging industry.

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Lower Charging Efficiency Than Wired Charging

Wireless EV charging solutions have lower charging costs than cable EV stations. This wastes power and increases expenses. Wired charging is an inexpensive solution for everyday use. Wired EV charging is quicker than wireless EV charging. Wired EV charging is also more cost-effective than wireless charging due to the difficulties of implementation in various scenarios. Furthermore, wireless charging solutions require a reliable connection between the EV's charging pad and the receiver coils. Misalignment or an insufficient space between the coils might reduce power transmission efficiency. This restriction does not apply to electrical equipment that offers a more stable and constant connection.

Higher Investment in Infrastructure For Dynamic Charging

Depending on the charging method, the electric car wireless charging business is classified as static charging or dynamic charging. Stationary charging involves wirelessly charging an electric automobile while it is parked on a charging pad. Dynamic charging allows the car to be charged while driving. Electronic payments may take place along a unique route with payment information encoded underneath it. The biggest issue with dynamic charging technology is the significant expenditure required to build a road equipped with wireless charging technology. The manufacturer does not mention the power loss experienced during dynamic charging.

Dynamic charging methods are typically more difficult and costly to deploy than wireless charging options. High investment in electric charging may result in a concentration on the most expensive and sophisticated systems, making wireless EV charging alternatives simpler and more affordable for users.

In May 2017, Qualcomm Technologies showed energy charging technology with a Renault Kangoo in Versailles, France. During the test, a car equipped with wireless charging technology charges its battery with 20 kW at 100 km/h to a buried charging pad on the road. Use high power to fast charge the battery. Stationary appliances require between 3.3 and 6.6 kW and take several hours to completely charge. The 100-meter-equipped track costs $10.1 million and is partially supported by the European Commission.

Magnetic Resonance Charging Segment: Leading Share Asia Pacific

In the rapidly evolving landscape of electric vehicle (EV) technology, wireless charging has emerged as a pivotal advancement, promising greater convenience and efficiency for electric car owners. Among the various wireless charging methods, magnetic resonance charging stands out as a frontrunner, poised to dominate the electric car industry in the coming years. This surge in adoption is largely attributed to major automotive Original Equipment Manufacturers (OEMs) like Hyundai Motor Company and FAW, who have embraced magnetic resonance charging technology as a key component of their EV offerings.

However, the landscape is not solely defined by automotive giants. Companies such as InductEV Inc. and HEVO Inc. have entered the fray, collaborating with specialists to explore the potential of inductive charging technology. These endeavors underscore the diverse avenues being explored within the realm of wireless charging, each with its unique set of opportunities and challenges.

One notable player in this arena is WAVE Charging, which has been pioneering wireless electric car charging technology. Their innovative approach holds the promise of revolutionizing how electric vehicles are powered and charged, paving the way for a future where the hassle of plugging in becomes a thing of the past.

Looking ahead, the Asia-Pacific region emerges as a powerhouse in the wireless charging industry, with countries like China, Japan, and South Korea at the forefront of innovation and adoption. Projections suggest that by 2030, this region will exert significant influence over the trajectory of wireless charging technology, setting the stage for widespread integration and acceptance on a global scale.

The rise of magnetic resonance charging, coupled with the exploration of alternative approaches like inductive charging, is reshaping the landscape of electric vehicle charging. With pioneering companies driving innovation and major markets leading the charge towards widespread adoption, the future of wireless charging in the electric car industry appears promising and full of potential.

The burgeoning market for wireless charging in electric vehicles is poised for remarkable expansion, driven by several key factors. Firstly, the soaring popularity of electric vehicles (EVs) worldwide has catalyzed a surge in demand for convenient and efficient charging solutions. As consumers increasingly embrace the environmental and economic benefits of EVs, the need for seamless charging experiences becomes paramount.

The EV ecosystem, the battery electric vehicle (BEV) segment is witnessing unprecedented growth. This uptick in BEV adoption, fueled by advancements in battery technology and a growing emphasis on sustainability, underscores the critical role that wireless charging technologies will play in facilitating the widespread adoption of electric mobility.

At the heart of this evolution lie advancements in wireless charging technology, particularly in the realms of magnetic resonance charging and inductive charging. These cutting-edge innovations promise to revolutionize the way EVs are powered and charged, offering greater convenience, safety, and efficiency compared to traditional plug-in methods.

Moreover, the Asia-Pacific region stands out as a key battleground for wireless charging innovation and adoption. With robust business ecosystems and strong government support for clean energy initiatives, countries like China, Japan, and South Korea are poised to emerge as significant drivers of economic growth in the EV sector. Their proactive approach to infrastructure development and policy incentives bodes well for the widespread integration of wireless charging solutions in the region.

The convergence of factors such as the surging demand for EVs, the rapid growth of the BEV segment, and technological advancements in wireless charging is propelling the market towards unprecedented growth. Against the backdrop of strong business and government support in the Asia-Pacific region, the future of wireless charging in the electric vehicle industry appears bright, promising a more sustainable and interconnected mobility ecosystem for generations to come.

Increasing demand for semi-autonomous vehicles

The surge in demand for semi-autonomous vehicles in recent years has been a significant catalyst for the growth of the wireless charging market within the electric vehicle (EV) industry. These cutting-edge vehicles, equipped with advanced sensors and navigation capabilities, have reshaped the automotive landscape by offering enhanced safety, convenience, and efficiency.

A semi-autonomous vehicle represents a leap forward in automotive technology, possessing the ability to autonomously sense its environment, navigate to its destination with minimal human intervention, and respond to commands via voice recognition. With features like parking assistance, forward collision avoidance systems, and advanced cruise control, these vehicles provide a glimpse into the future of transportation.

Integrating wireless car chargers into semi-autonomous vehicles further amplifies their convenience and utility. By eliminating the need for manual plugging into electrical outlets, wireless charging technology seamlessly integrates into the driving experience, allowing drivers to effortlessly replenish their vehicle's battery while on the move.

This integration holds significant promise for driving the adoption of wireless electric vehicle charging systems. In particular, semi-autonomous vehicles equipped with automatic parking features can leverage wireless charging pads installed at designated charging stations. This streamlined process enables the vehicle to autonomously position itself over the charging pad, initiating the charging process without any manual intervention from the driver.

The convergence of semi-autonomous vehicle technology and wireless charging solutions is expected to fuel the growth of the electric vehicle charging infrastructure. By enhancing convenience, accessibility, and automation, these advancements are poised to accelerate the transition towards a more sustainable and interconnected mobility ecosystem.

Wireless Charging Electric Vehicle Market Key Players

- Hella Aglaia Mobile Vision

- Witricity Corporation

- Momentum Dynamics Corporation

- Elix Wireless Inc.

- Mojo Mobility

- EFACEC

- ZTE Corporation

- Evatran Group Inc.

- HEVO Inc.

- Tgood Electric Co

- Continental AG

- Robert Bosch GmbH

- Hella Kgaa Hueck & Co.

- Toyota Motor Corporation

- Toshiba Corporation

Wireless Charging Electric Vehicle Market Recent Developments

- In October 2023, ChargePoint, a leading electric vehicle charging network, launches its RapidCharge initiative, offering automakers the opportunity to integrate fast wireless charging technology into their EV models within 120 days. This initiative streamlines the process for automakers to incorporate ChargePoint's high-speed wireless charging solutions, enhancing convenience and accessibility for electric vehicle owners.

- In September 2023, Chinese electric vehicle manufacturer NIO partners with Qualcomm Technologies to deploy Qualcomm's Halo wireless electric vehicle charging technology in NIO's upcoming models. This collaboration aims to deliver seamless wireless charging experiences to NIO customers, leveraging Qualcomm's advanced wireless charging technology to enhance efficiency and reliability.

- In August 2023, Tesla announces the development of its proprietary wireless charging system for its Model S Plaid electric sedan. This groundbreaking technology enables Tesla owners to wirelessly charge their vehicles at home or at designated charging stations, further advancing the company's commitment to innovation and sustainability in the electric vehicle market.

- In July 2023, BMW unveils its Vision iNEXT concept car, featuring integrated wireless charging capabilities powered by Qualcomm's innovative charging solutions. The Vision iNEXT showcases BMW's vision for the future of electric mobility, offering seamless wireless charging experiences for drivers and contributing to the widespread adoption of electric vehicles worldwide.

- In June 2023, Ford Motor Company collaborates with Plugless Power to integrate Plugless's wireless charging technology into its lineup of electric and hybrid vehicles. This partnership marks a significant step forward in Ford's electrification efforts, providing customers with convenient and efficient wireless charging solutions that complement the company's commitment to sustainability and innovation.

- In May 2023, Nissan partners with WiTricity Corporation to develop and deploy wireless charging technology for its next-generation electric vehicle models. Leveraging WiTricity's expertise in wireless charging systems, Nissan aims to deliver enhanced charging experiences to its customers, simplifying the process of powering electric vehicles and accelerating the transition to electric mobility.

Browse More Insights of Towards Automotive:

- The global automotive air suspension systems market size was at USD 19.15 billion in 2022 estimated to grow at a CAGR of 4.88% from 2023 to 2032 and reach USD 29.41 billion by the end of 2032.

- The global automotive composites market size is projected to grow significantly, reaching USD 21.03 billion by 2032. The market is expected to achieve a double digit CAGR of 10.76% during the forecast period, starting from USD 8.39 billion in 2022.

- The automotive anti-lock braking system market size was valued at USD 59.58 billion in 2022 and is expected to reach USD 131.58 billion by 2032, growing at a CAGR above 9% during the forecast period (2023 - 2032).

- The automotive electronic stability control system market size was valued at USD 40.65 billion in 2022 and is expected to expand to USD 106.91 billion by 2032, with an increase in CAGR of more than 11.34%.

- The automotive interior material market size is anticipated to witness substantial growth, projecting an increase from USD 58.26 billion in 2023 to USD 84.27 billion by 2032. The CAGR for the forecast period (2023-2032) is estimated at 4.19%.

- The automotive pneumatic actuator market size was valued at USD 20.04 billion in 2022, is developing strongly. With a predicted value of USD 32.30 billion at the end of the projection period in 2032, it has a CAGR of more than 5.44% from 2023 to 2032.

- The automotive smart key market size is expected to increase from USD 18.25 billion in 2023 to an estimated USD 27.67 billion by 2032, with a compound yearly growth rate (CAGR) of 5.42% over the forecast period (2023-2032).

- The automotive seat market was valued at USD 82.46 billion in the year 2022, and it is expected to reach 143.10 billion by the year 2032 growing at a CAGR of 5.48% during the forecast period.

- The market value of automotive Tire Pressure Monitoring Systems (TPMS) to rise from USD 8.38 billion in 2022 and anticipated to reach USD 23.52 billion by 2032, with a CAGR of 10.10% during the forecast period.

- The high-performance trucks market size was valued at USD 76.68 billion in 2023 and is expected to reach USD 110.48 billion by 2032, registering a CAGR above 4.14% during the forecast period.

By Application

- Commercial Charging Stations

- Home Charging Units

By Component

- Base Charging Pads

- Power Control Units

- Vehicle Charging Pads

By Charging Type

- Dynamic Wireless Charging Systems

- Stationary Wireless Charging Systems

By Propulsion

- BEVS

- PHEVS

By Vehicle Type

- Commercial Vehicles

- Passenger Cars

By Power Supply Range

- Up to 3.7 kW

- Above 3.7-7.7 kW

- Above 7.7-11 kW

- Above 11 kW

By Charging System

- Magnetic Resonance Charging

- Inductive Charging

- Capacitive Charging

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Acquire our comprehensive analysis today @ https://www.towardsautomotive.com/price/1031

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Subscribe to our Annual Membership and gain access to the latest insights and statistics in the automotive industry. Stay updated on automotive industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the competition with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of automotive: Get a Subscription

About Us

Towards Automotive is a premier research firm specializing in the automotive industry. Our experienced team provides comprehensive reports on market trends, technology, and consumer behaviour. We offer tailored research services for global corporations and start-ups, helping them navigate the complex automotive landscape. With a focus on accuracy and integrity, we empower clients with data-driven insights to make informed decisions and stay competitive. Join us on this revolutionary journey as we work together as a strategic partner to reinvent your success in this ever-changing packaging world.

Web: https://www.precedenceresearch.com

Browse our Brand-New Journals:

https://www.towardspackaging.com

https://www.towardshealthcare.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-automotive

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.